Understanding Payroll Gross-Up for Incentives

When it comes to employee compensation, one term that often comes up is “grossing up.” This practice is particularly useful when dealing with bonuses. But what exactly does it mean to Gross-Up wages, and why is it beneficial? Let’s dive into the details for this week’s blog.

You may be asking yourself what a Gross-Up is, it’s a method used by payroll to ensure that employees receive a specific net amount after taxes are deducted. Essentially, the employer increases the gross amount of the bonus to cover the employee’s tax liabilities, so the net pay remains as intended.

For example, if an employer promises a $1000 bonus, they will calculate and add the necessary amount to cover the taxes, ensuring the employee takes home the full $1000. We see this happen when employers issue bonuses or relocation expenses. Employees this way will receive more take-home pay.

How to Calculate a Gross-Up

Calculating a gross-up involves some math, but it’s straightforward once you understand the formula. Steps below:

1. Determine the Desired Net Pay: This is the amount you want the employee to receive after taxes. In our example, the bonus is $1000 and we want $1000 to be the net amount for our employee.

2. I

dentify the Tax Rate: This includes federal, state, and any other applicable taxes. (Percentages shown are an example please review IRS rates and state/local websites if any changes are applicable)

- Federal 22%, Social Security 6.2%, Medicare 1.45%

- Tax Rate 29.65%

3. Use the Gross-Up Formula:

- Gross-Up Amount=Desired Net Pay/ (1-Tax Rate)

- 1000/ (1-.2965) =1000/0.7035=1421.46

4. So, the gross amount would be approximately $1421.46

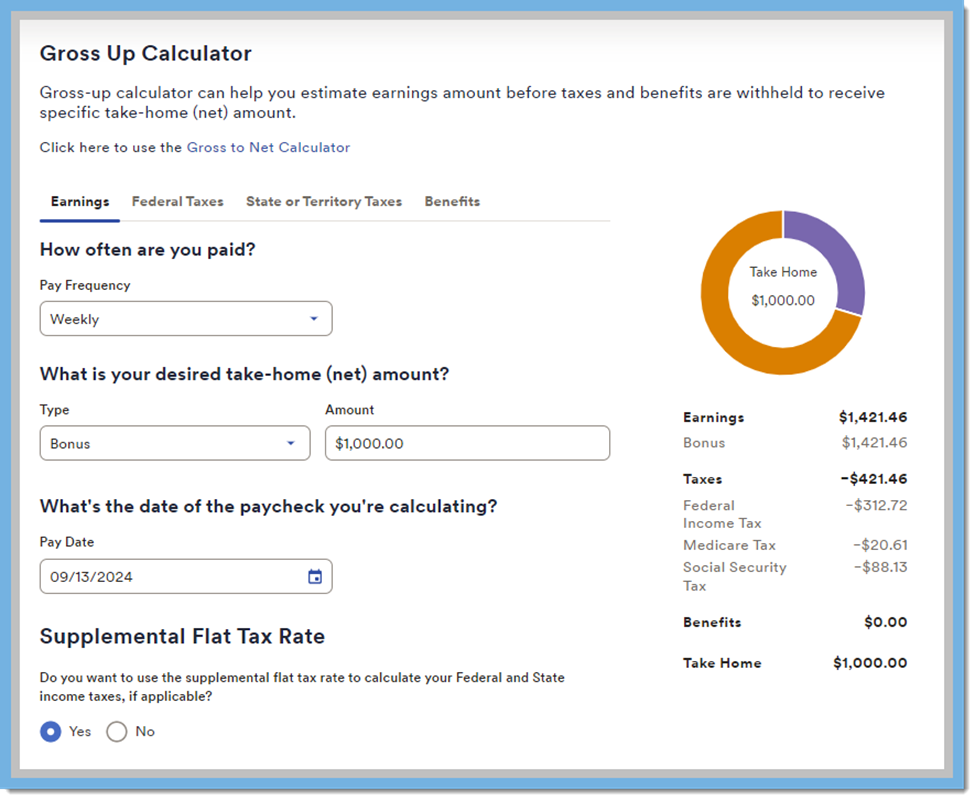

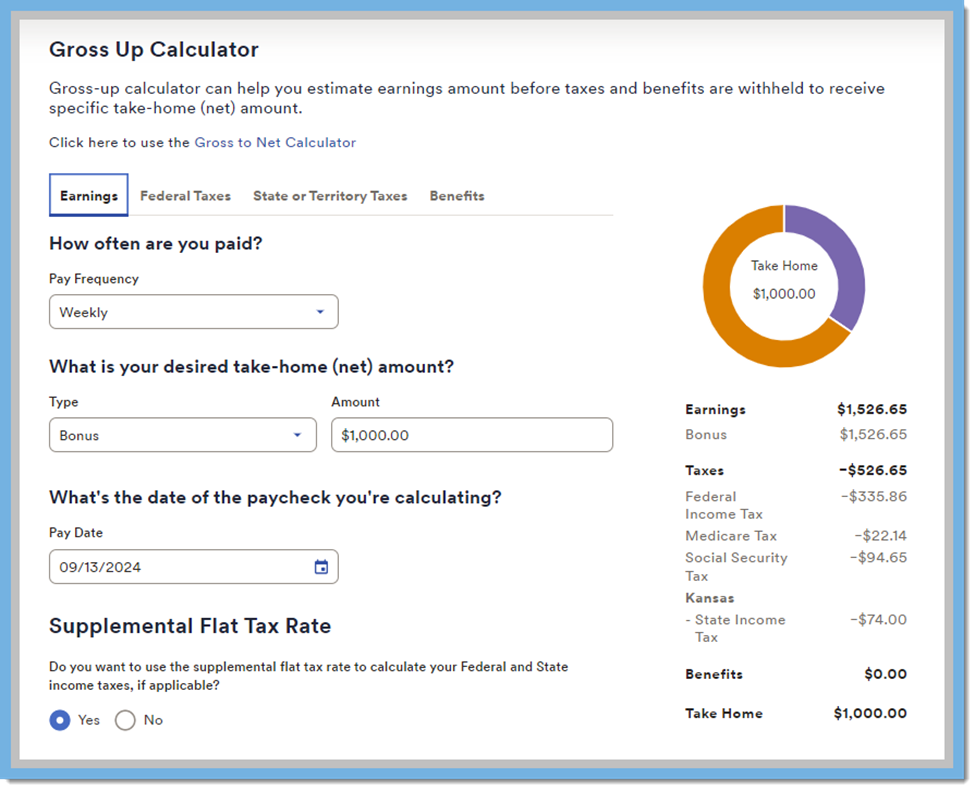

Some helpful advice is to find your favorite Gross-Up calculator online. There are several free resources online, the one below is

ADP’s free Gross-Up Calculator , ADP’s website has many helpful resources for payroll. Some of my favorites are

Fast Facts and the Gross-Up Calculator.

In the example below the supplemental flat tax rate was applied and no state income taxes were used.

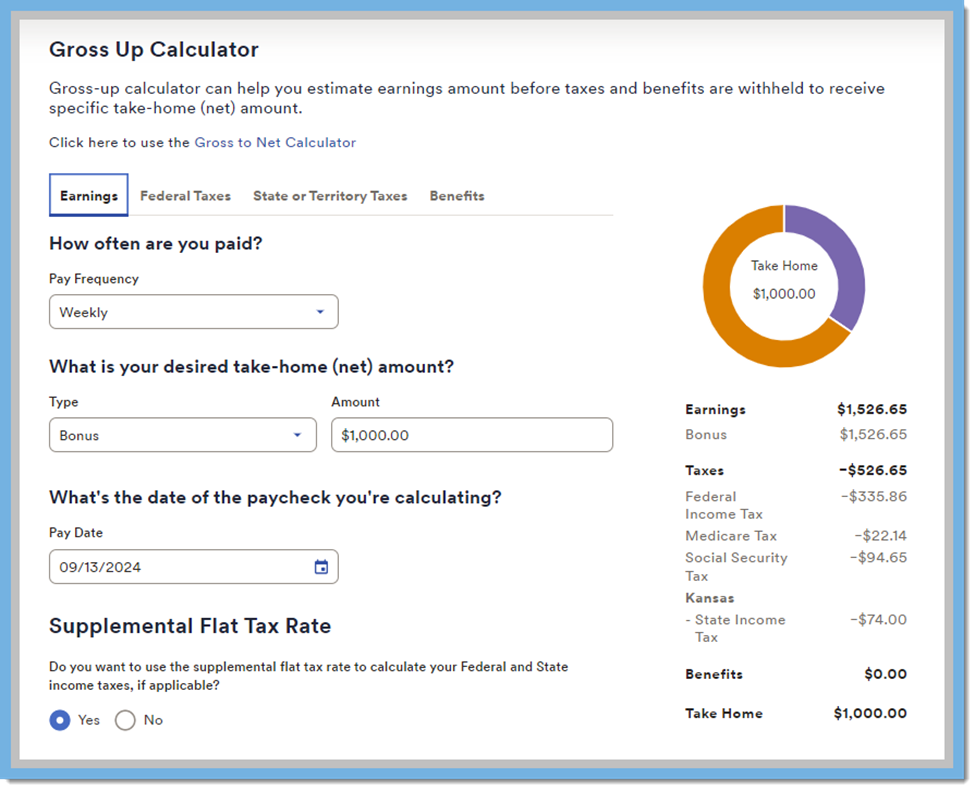

Next Example with State Income Tax from Kansas

Next Example with State Income Tax from Kansas

Now the amount for the bonus has changed to include the state income tax. In this example the supplemental rate was also used. Most states have supplemental rates but be sure to check with your tax expert.

Grossing up bonuses is a thoughtful practice that can significantly enhance employee satisfaction and simplify payroll processes. By understanding and implementing this method, employers can ensure their compensation packages are both competitive and appreciated by their workforce.

On a previous Tip Tuesday, my colleague Susan Hanly wrote a blog post called

Bonus Setup & Processing Tips that explains the bonus setup features and processing tips within Vista. The blog is informative and helpful in understanding how bonuses are set up on the Pay Period Control, PR Deduction/Liabilities, and steps for processing. Please give that blog a read as well.

As always, if you need assistance with any Vista processes, please visit our website

ConstrucTech Consulting and Book a Call with one of our consultants.

Grossing up bonuses is a thoughtful practice that can significantly enhance employee satisfaction and simplify payroll processes. By understanding and implementing this method, employers can ensure their compensation packages are both competitive and appreciated by their workforce.

Grossing up bonuses is a thoughtful practice that can significantly enhance employee satisfaction and simplify payroll processes. By understanding and implementing this method, employers can ensure their compensation packages are both competitive and appreciated by their workforce.