ConstrucTech Consulting, LLC

Tidying Up 1099 Type and Box # Information in Vista for Tax Year 2023

By Susan Hanly - Associate Consultant

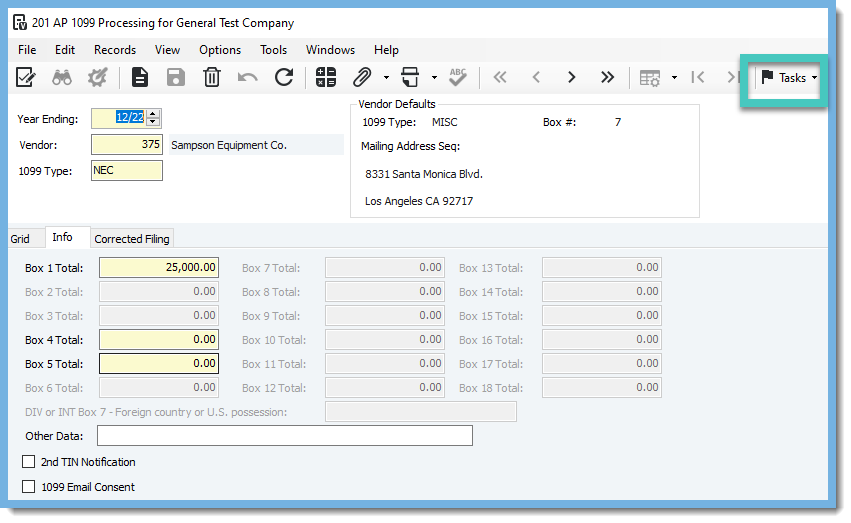

Drop down on Tasks and choose Edit Transactions.

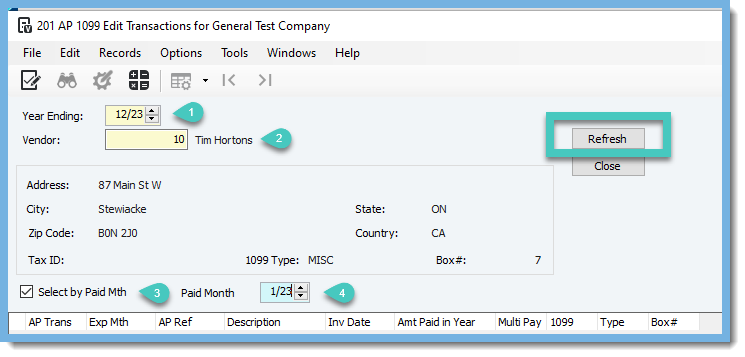

Drop down on Tasks and choose Edit Transactions. 1. Year Ending - Enter the Year Ending month.

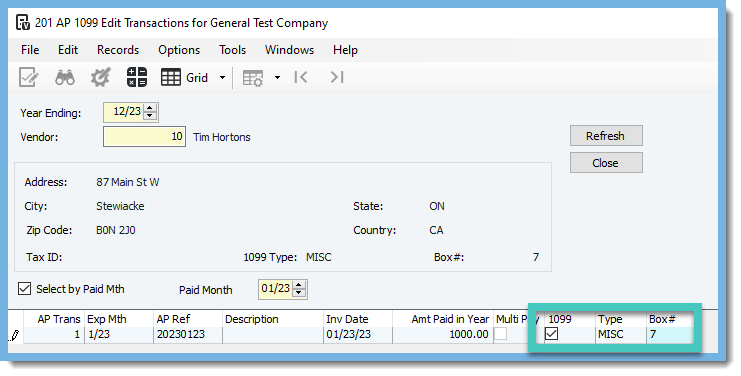

1. Year Ending - Enter the Year Ending month. In the example above, the 1099 vendor was paid $1,000 in January 2023 prior to the correction being made to this vendor. This vendor was originally setup as a MISC Type Box 7. After reconciling 2022 1099 information, it was discovered that this vendor should be NEC Type Box 1. This can be corrected as seen on the screen below.

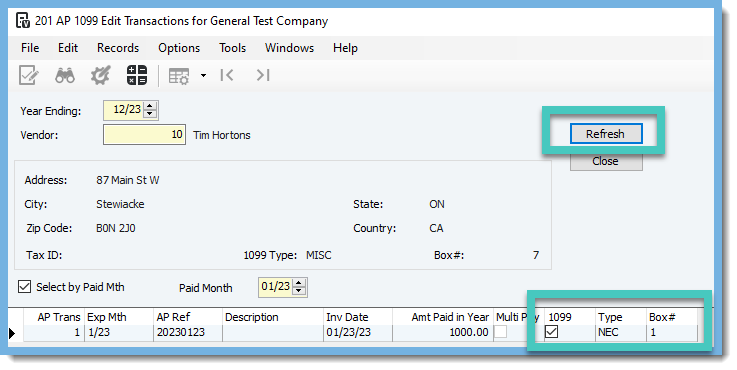

In the example above, the 1099 vendor was paid $1,000 in January 2023 prior to the correction being made to this vendor. This vendor was originally setup as a MISC Type Box 7. After reconciling 2022 1099 information, it was discovered that this vendor should be NEC Type Box 1. This can be corrected as seen on the screen below. After correcting the Type and Box#, click on the Refresh button and close out of the screen.

After correcting the Type and Box#, click on the Refresh button and close out of the screen.